Australian Transport Industry Consolidation:

What’s Really Driving the Wave of Mergers, Acquisitions & Private Equity Investments…

Australia’s transport and logistics sector is undergoing its largest structural shift in decades, and it’s happening fast.

A wave of mergers, acquisitions, and private equity-led takeovers is resaping the competitive landscape, reducing the number of independent operators, and accelerating the transition toward large, integrated, capital-backed supply chain networks.

From multinational giants to domestic PE funds, investors are aggressively buying into (and consolidating) the sector, signalling both opportunity and risk for the broader industry.

Here is a breakdown of the key. →

Why is the Transport Sector Consolidating So Quickly?

Financial fragility + rising costs are pushing smaller players to exit

Many operators are struggling with rising wages, insurance, fuel volatility, elevated finance rates, and tight margins. This has created conditions where selling is safer than continuing to trade.

Larger corporates, or PE firms with capital reserves, are stepping in to acquire distressed or strategic assets.

Investors see long-term upside in supply chain control

Many operators are struggling with rising wages, insurance, fuel volatility, elevated finance rates, and tight margins. This has created conditions where selling is safer than continuing to trade.

This improves network efficiency, cost control, customer lock-in and scale advantages.

For global logistics giants, Australia is a high-value but fragmented market - ripe for consolidation.

Private equity sees opportunity in turnarounds.

Firms such as Allegro and Macquarie are focusing on transport and logistics operators that offer:

strong infrastructure

brand equity

national networks

operational inefficiencies they can “fix” through capital + restructuring

These deals are classic PE plays: buy undervalued, streamline, scale, and exit at a premium.

Harmony with global consolidation trends.

What we’re seeing in Australia mirrors global patterns in the US, UK, and Europe: transport is becoming increasingly dominated by:

large, multi-modal corporates

global integrators

private equity consolidators

tech-enabled fourth-party logistics (4PL) orchestrators

Scale and capital now matter more than ever.

What This Means for the Market.

Fewer carriers, bigger networks

Family-owned and mid-tier carriers are being absorbed into national brands, reducing competition and choice.

Increased reliance on “mega networks”.

Major players (DHL, FedEx, DP World, Aurizon, SCT, Lindsay, Centurion, etc.) now control larger pieces of the national freight task.

Higher price discipline.

Large strategic acquirers don’t run discounted or unsustainable pricing.

Risk of reduced agility.

Bigger companies often lose the service flexibility and responsiveness that smaller carriers traditionally delivered.

Supply Chain fragility for customers

When mergers occur, customers often face:

service realignments

network redesign

changed pricing structures

commercial renegotiations

operational integration disruptions

For freight-heavy businesses, these can materially impact DIFOT, cost-to-serve, and customer experience.

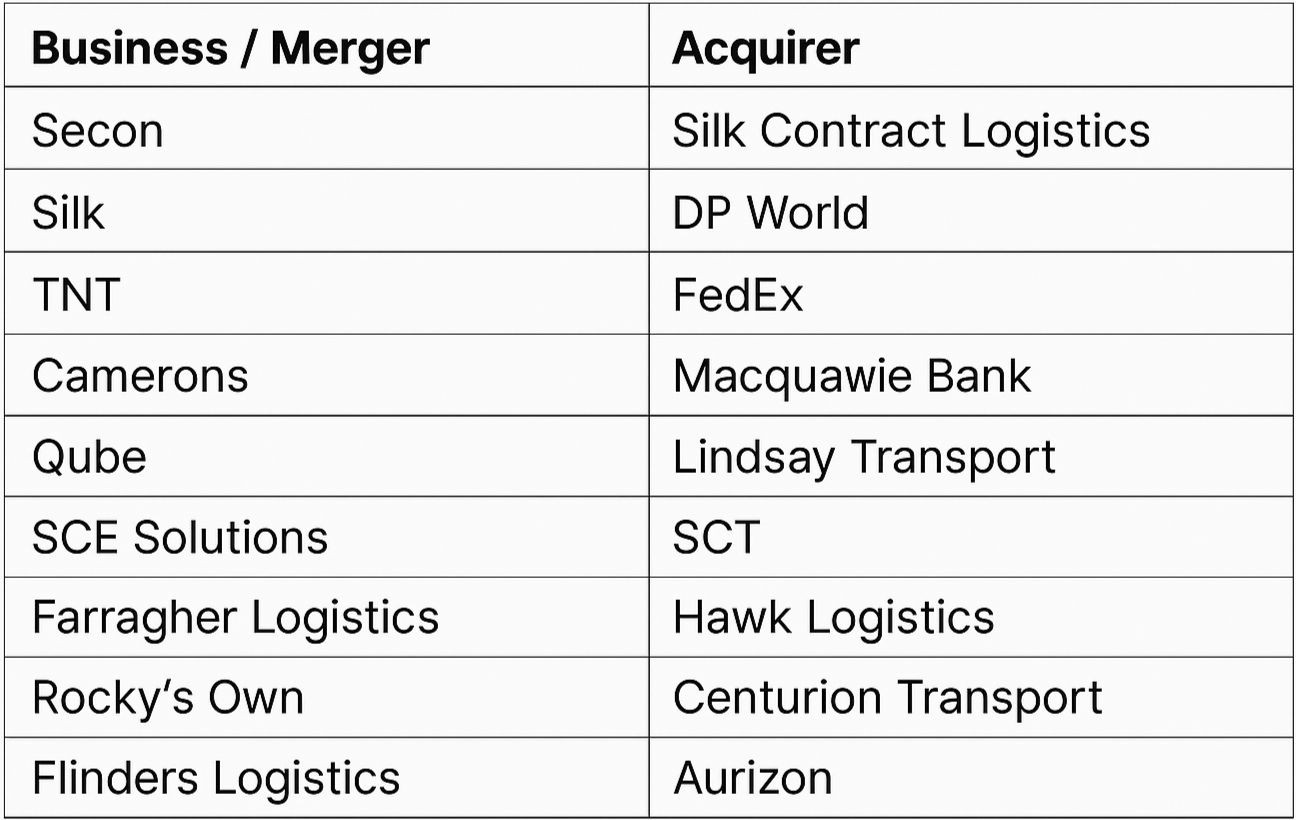

Key acquisitions and what they tell us!

Secon → Silk Logistics (completed 31 Aug 2023)

Deal size: ~A$35m (A$30m cash + A$5m in Silk shares, plus an earn-out).

Why it matters: Strengthened Silk’s national container and port logistics footprint ahead of its own take-private bid by DP World.

Silk Logistics → DP World (announced 11 Nov 2024, in progress)

Deal size: ~A$174.5m equity value (A$2.14 per share; ~45–60% premium to pre-bid price).

Timing: Scheme announced Nov 2024; ACCC review ongoing through 2025.

Why it matters: Classic vertical integration – a global terminal operator buying a major national container transport provider, raising competition concerns about port/landside power.

TNT Express → FedEx (global, completed May 2016)

Deal size: €4.4bn (~US$4.8bn) all-cash offer for TNT’s equity.

Timing: Offer announced April 2015; deal declared unconditional and settled in May 2016.

Why it matters: Brought an Australian-founded global parcel player under US ownership and set the tone for mega-scale global consolidation.

Glen Cameron Group (“Camerons”) → DHL Supply Chain (completed 2022)

Deal size: Value undisclosed, but combined DHL + Cameron revenue now >A$1bn in Australia.

Timing: Deal announced June 2022; completion confirmed August 2022.

Why it matters: Turned DHL’s Australian Road freight and contract logistics into a “third pillar” of its local business, deepening global control over domestic freight flows.

Toll Global Express → Allegro Funds (completed 1 Sept 2021)

Deal size: Purchase price not formally disclosed; reporting suggests <A$10m net proceeds to seller with Allegro assuming significant liabilities and committing ~A$500m of turnaround capital.

Timing: Transaction announced in 2021; completion 31 Aug–1 Sept 2021.

Why it matters: Flagship example of distressed infrastructure/logistics being carved out of a legacy group and rebuilt under private-equity ownership.

Qube → Macquarie Asset Management (proposed 2025–26)

Deal size: A$9.2bn equity / A$11.6bn enterprise value all-cash bid at A$5.20 per share (~28% premium).

Timing: Non-binding proposal announced Nov 2025; Qube board supports the deal in the absence of a superior offer, subject to approvals.

Why it matters: If completed, it will likely privatise Australia’s largest integrated import/export logistics provider and remove another major listed logistics company from the ASX – a huge signal of global capital’s appetite for these assets.

Bag Trans → FMH Group / efm Logistics (completed Jan 2021)

Deal size: Undisclosed purchase price.

Timing: Acquisition announced 29 Jan 2021.

Why it matters: Bag Trans’ pallet LTL network became part of FMH Group (parent of 4PL efm). FMH itself was later sold by Sing Post to Pacific Equity Partners in an A$1.02bn enterprise-value deal in 2024, showing the PE “roll-up” of these mid-tier networks.

SRT Logistics → Lindsay Australia (announced May 2025)

Deal size: Around A$108–108.2m for 100% of Tasmania’s largest refrigerated logistics provider (mix of cash and assumed debt/equity).

Timing: Binding agreement signed 13 May 2025; completion expected by 30 June 2025

Why it matters: Creates Australia’s largest refrigerated logistics network and plugs Lindsay directly across the Bass Strait.

CRE (not SRE) Solutions Logistics → SCT Logistics (closed 31 Mar 2025)

Deal size: Undisclosed.

Timing: Acquisition announced 18–20 March 2025; transaction closed 31 March 2025

Why it matters: Strengthens SCT’s Bass Strait and Tasmanian presence and adds multi-modal revenue streams, further scaling one of the few large Australian-owned intermodal operators.

Farragher Logistics → Hawk Logistics (announced Dec 2024)

Deal size: Undisclosed; deal adds 14 prime movers, 22 refrigerated trailers and helps take Hawk to 800+ pieces of equipment.

Timing: Acquisition announced Dec 2024, following several months of negotiations.

Why it matters: A 91-year-old family business absorbed into a fast-growing refrigerated player – a classic example of generational exit + growth-by-acquisition.

Rocky’s Own Transport → Centurion (effective 1 July 2023)

Deal size: Undisclosed asset sale.

Timing: Acquisition effective 1 July 2023; public announcements July 2023.

Why it matters: Expands Centurion’s dangerous goods and mining exposure and takes its workforce to >2,000 people nationally, showing the aggressive build-out of national heavy-haul capability.

Flinders Logistics → Aurizon (completed 6 Dec 2024)

Deal size: A$26m for 100% of Flinders Logistics.

Timing: Sale agreement 18 Apr 2024; ACCC raised concerns in July 2024, then cleared the restructured deal on 28 Nov 2024; completion 6 Dec 2024.

Why it matters: Deepens Aurizon’s rail + port integration in SA (Port Adelaide and Port Pirie stevedoring), exactly the kind of infra convergence that worries regulators and reshapes bargaining power for bulk shippers.

What does this pattern really show us?

When you line these deals up, a few themes jump out very clearly.

1. The timeline is tight and recent

o Most of the Australian deals are 2021–2025, with values from the tens of millions (Secon, Flinders) up to multi-billion-dollar plays (Qube, FMH, Silk/DP World).

o In a four-to-five-year window, a significant chunk of the national logistics backbone has changed hands or moved under global/PE control.

2. Global strategics are locking in end-to-end control

o DHL, FedEx, DP World and Aurizon are all using M&A to secure vertically integrated networks – terminals + road + warehousing, often with strong intermodal positions.

3. Private equity and infrastructure funds are now major owners of freight capacity

o Allegro with Toll Global Express, PEP with FMH/efm, and Macquarie’s live bid for Qube together represent billions in PE/infra capital now sitting behind Australian freight flows.

4. Mid-tier and family businesses are being rolled into larger platforms

o Secon, Bag Trans, SRT, Farragher, Rocky’s Own and CRE all show the same story: long-standing regional networks and specialist fleets becoming part of national, tech-enabled or PE-backed platforms.

5. Regulators are paying attention, but deals are mostly getting through

o Both the DP World – Silk and Aurizon – Flinders deals have attracted ACCC scrutiny on competition grounds, but Aurizon’s deal ultimately proceeded after structural tweaks, and DP World’s is still under review.

What This Timeline Actually Shows Us.

Across just four years, Australia has undergone one of the fastest consolidation waves in transport history. Multinational giants (DHL, DP World, FedEx), private equity funds (Allegro, PEP, Macquarie), and national logistics platforms (Lindsay, SCT, Centurion) have absorbed some of the country’s most established carriers.

Deal values range from $ 26 million to more than $ 9 billion, proving how aggressively capital is flowing into freight assets.

The pattern is clear: scale, integration, and capital strength now define market power and mid-tier, and family operators are rapidly being rolled into larger networks as succession, cost pressures, and competition take their toll.

For customers, this means fewer choices, more concentrated networks, and greater dependency on large, capital-backed operators whose service models may shift after acquisition.

For the industry, it marks the transition from a historically fragmented carrier landscape to a highly consolidated, integrated, and investor-driven transport ecosystem.

Why 4PL Models Are Becoming Essential in a Consolidating Market

As carriers get absorbed into larger, more rigid networks and mid-tier operators disappear, the role of neutral, independent 4PLs becomes increasingly valuable.

A 4PL provides what a single carrier or integrated network cannot:

✓ Multi-carrier redundancy

If one carrier exits, gets acquired, or restructures its network, the freight keeps flowing through an alternative partner.

✓ Independence from carrier bias

A 4PL isn’t tied to one fleet, one depot, or one market strategy. It orchestrates what’s best for the customer, not the owner of the trucks.

✓ Protection from consolidation risk

When carriers are bought out, service models change. A 4PL ensures continuity and stability across transitions.

✓ Better pricing governance

A diversified network avoids the “price lock-in” effect common when large players absorb competitors.

✓ National reach without relying on one supplier

This is critical as local and regional carriers are increasingly swallowed by major logistics groups.

Why Deliver Group is Built for the New Transport Landscape.

Deliver Group’s next-generation 4PL model is purpose-built for a consolidating industry where:

Carrier choice is shrinking

Private equity is reshaping networks

Customer risk is increasing

Performance volatility is rising

Deliver Provides:

A multi-carrier national ecosystem

Real-time performance analytics

proactive risk monitoring

agile carrier selection

scalable orchestration across all transport modes

genuine cost-to-serve optimisation

continuity when carriers are bought, sold, or restructured

As the market consolidates, independent orchestration becomes the smartest, lowest-risk operating model for Australian freight users.

And that’s exactly why Deliver is here to provide